Every Big Win Starts With One Small Step Make Yours!

Great achievements don’t happen overnight. Take your first step today and let success follow.

4+Years of Expertise

Pioneering blockchain andAi since day one

99.6%Client Satisfaction

Where ambition meetsexecution—every time.

100%Quality Assurance

Code audited,stress-tested, future-proofed.

150+Projects Delivered

From seed-stage startupsto enterprise ecosystems.

Next-Gen Cryptocurrency Exchange Development

for Visionary Founders

Planning to launch your own crypto exchange? We help emerging founders. We transform bold ideas into reliable, fully functional trading ecosystems. Users buy, sell, and swap assets like BTC, ETH, and USDT with ease. Building centralized (CEX) or decentralized (DEX) exchanges? We ensure your solution is fast, compliant, and market-ready in weeks.

Troniex Technologies delivers exchange platforms engineered for performance, transparency, and scalability. You get a microservices-driven architecture with a high-speed matching engine, integrated liquidity pools, robust KYC/AML verification, and multi-chain wallet infrastructure.

Our platform supports fiat gateways, advanced trading modules, AI-powered risk detection, and customizable referral and reward systems, all controlled through an intuitive admin panel.

Built with Reliability

Powered by Innovation

Guided by Experts

Trusted by Founders

Why Starting a Crypto Exchange Makes Business Sense Worldwide?

In 2025, the development of cryptocurrency exchanges stands at a tipping point, driven by rapid market expansion, technological innovation, and increasingly clear global regulations. As highlighted in our latest analysis of cryptocurrency exchange market trends, the ecosystem is evolving faster than ever, opening doors for scalable and secure platforms that can meet the surging global demand. Investing now means positioning your venture to unlock multiple revenue streams and lead the next wave of growth in the digital economy.

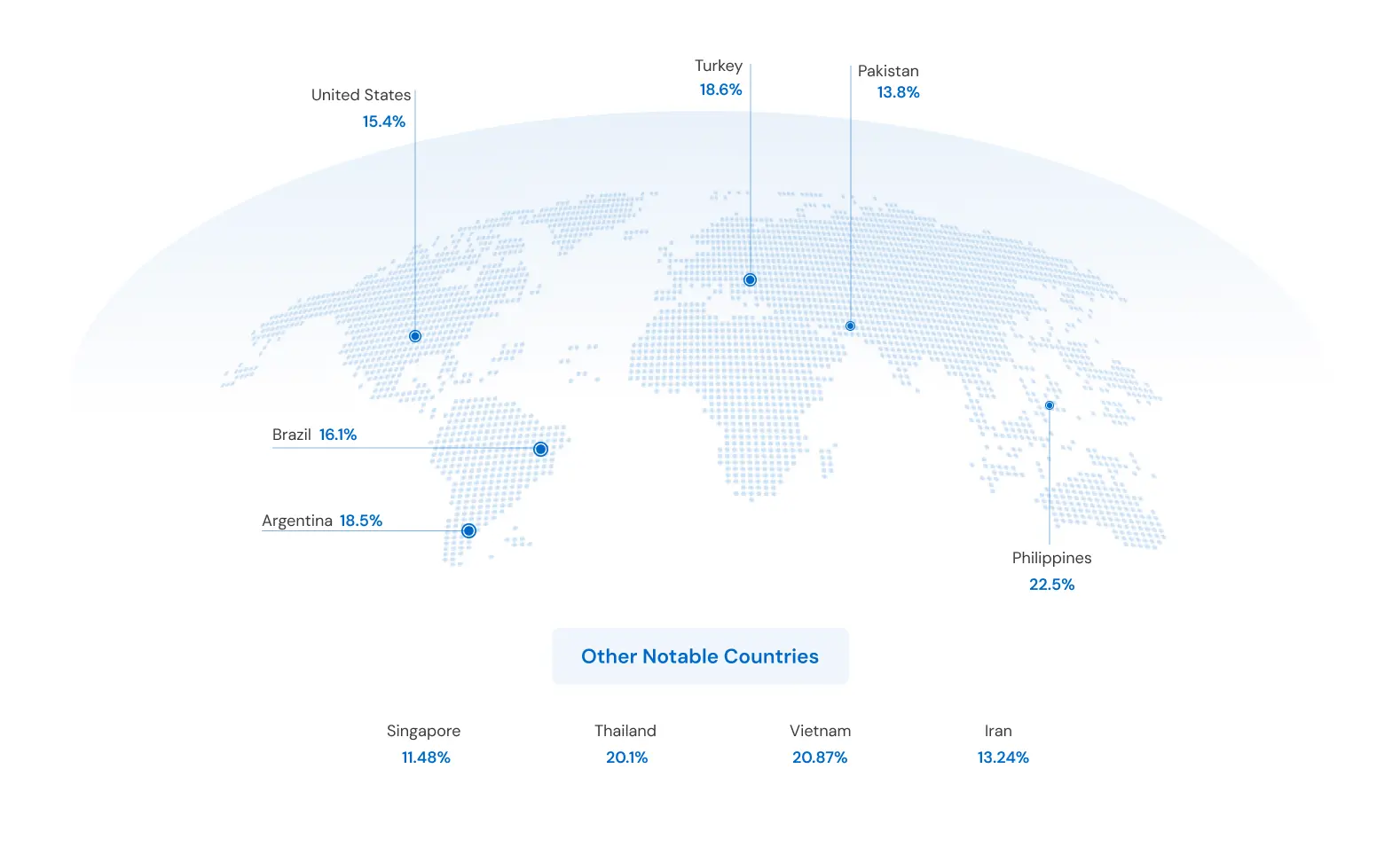

Strategic Regional Insights for Launching Crypto Exchanges

Key Markets and Growth Drivers

Unlock critical market intelligence to launch your own crypto exchange with confidence. Discover key regional growth drivers and seize the opportunity to capitalize on booming global demand in 2025.

Top Countries with the Most Active Crypto Users:

Engineering Success

Our Cryptocurrency Exchange Development Services

Unlock the full potential of crypto exchange with our fully structured cryptocurrency exchange development services. Explore our comprehensive crypto trading platform development assistance tailored to your business goals.

Crypto Exchange Consulting

Get our experts’ guidance for crypto exchange consulting, including architecture design, tech stack selection, compliance frameworks, and market positioning. We review your business model, spot technical gaps, and create an attainable development plan.

Custom Exchange Development

Develop a powerful crypto exchange featuring custom trading engines, high-throughput APIs, and a microservices architecture. We create crypto trading platforms with advanced order matching algorithms tailored for businesses seeking complete control.

Whitelabel Crypto Exchange Development

Deploy a ready-made white label crypto exchange equipped with customizable UI, multi-layer security, and REST/WebSocket APIs. The built-in order matching, KYC/AML modules, admin dashboard, and liquidity management tools can accelerate your launch.

Crypto Wallet Development

Our secure multi-currency crypto wallet development solutions ensure seamless transaction flow and real-time balance updates with exchange software to support both custodial and non-custodial wallets, and provide seamless wallet integration services.

Crypto Trading Bot Integration Services

Benefit from algorithmic crypto trading bot integration services that support grid trading, arbitrage, scalping, and Dollar Cost Averaging (DCA) strategies. Our crypto trading bot development solutions enable seamless API integration for real-time order execution, risk management, and market monitoring.

AI Powered Crypto Exchange Development

With AI Powered Crypto Exchange Development, integrate AI for fraud detection, trade analysis, and user recommendations. Deliver smart order routing, dynamic fees, and predictive analytics for a safer, smarter trading experience.

Exchange Maintenance Services

Get your exchange power backed with our 24/7 monitoring, uptime optimization, and regular patch updates. Our exchange maintenance service includes load balancing, DB optimization, and incident response handling, ensuring frontend performance.

Cryptocurrency Legal Solutions

Keep your exchange services aligned with global regulatory standards like GDPR, SEC, and MiCA. Our end-to-end legal solutions with complete jurisdiction research include crypto exchange licensing, KYC/AML compliance, and regulatory filing.

Crypto Payment Gateway Integration

Allow your traders to benefit from integrated crypto gateways that support multiple cryptocurrencies and token standards. Our crypto payment gateway development services ensure seamless invoice generation and secure API-based payment processing, helping your business function smoothly.

Dreaming of Running the Next Top Crypto Exchange?

Let’s make it happen; Get your free consultation now!

Scalable Crypto Exchange Software Development Services

for Modern Entrepreneurs

As a leading crypto exchange software development company, we are always committed to meeting client requirements. This principal responsibility is visible with our diverse range of crypto exchange development solutions

Centralized Exchange Development

Develop high-speed centralized exchanges with advanced admin controls and robust matching engines with our centralized exchange development services. Our exchange platforms are ideal for businesses preferring performance, scalability, and full operational oversight.

Decentralized Crypto Exchange Development

Our decentralized exchange software development services help you launch a DEX platform powered by smart contract functionalities. We offer a DEX solution with AMM and cross-chain functionalities, ideal for promoting user privacy and control.

Hybrid Crypto Exchange Development

Combine the best of centralized and decentralized exchanges with a hybrid platform. Our hybrid crypto exchange development solutions feature on-chain settlement, off-chain order books, and secure trade execution, delivering performance and privacy in one platform.

P2P Crypto Exchange Development

Build a P2P exchange with escrow services, dispute resolution, and support for multiple cryptocurrencies. Our P2P exchange development support fiat on/off ramps, and KYC modules, allowing users for direct trading safely.

OTC Crypto Exchange Development

Maximise your profitability with OTC exchange development featuring high-volume crypto trades with minimal market impact. Features like deal space, custom pricing, and multi-user access keep the essence of direct trading precise.

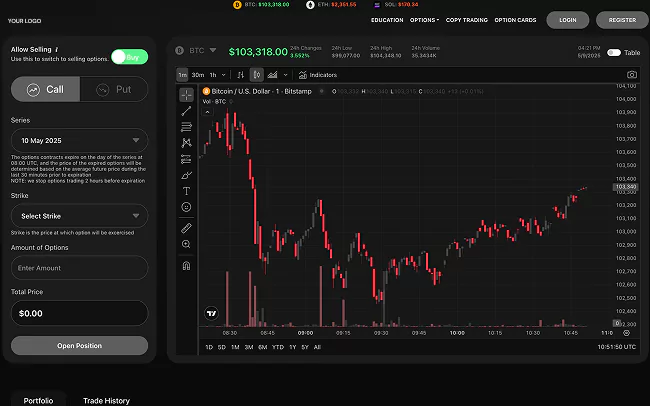

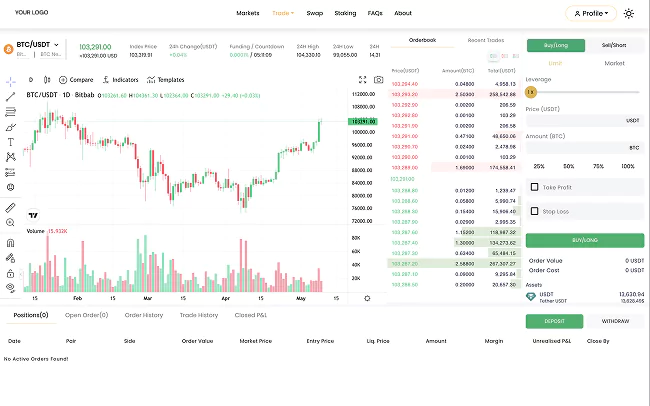

Crypto Derivative Exchange Development

Build advanced derivative trading platforms that support perpetual contracts, futures, and options. Our derivative exchange solutions leverage control, real-time risk management, and charting tools best for traders seeking high-performance trading options.

Escrow Exchange Development

Create secure escrow exchange platforms that act as trusted middlemen, holding funds safely until both buyers and sellers meet agreed terms. Our escrow solutions prioritize trust and transparency, protecting users from fraud and ensuring smooth, reliable transactions.

Bitcoin Exchange Development

Develop specialized Bitcoin exchange platforms focused on secure, fast, and efficient trading of the world’s leading cryptocurrency. Our Bitcoin exchange solutions feature robust wallet integration, high-performance trading engines, and advanced security protocols to deliver a seamless trading experience for users worldwide.

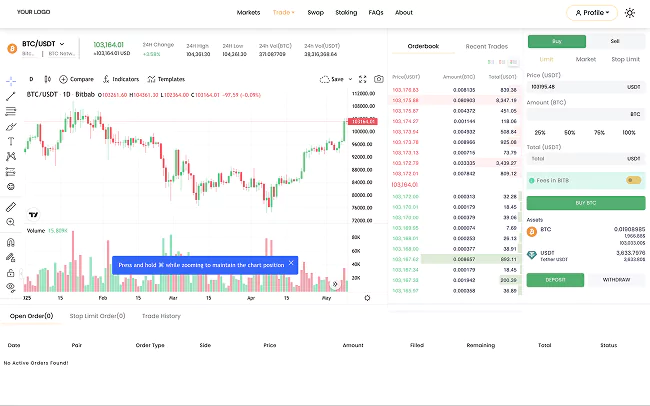

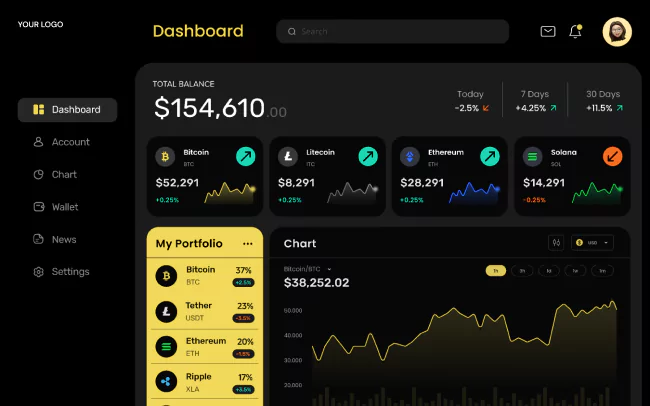

A Glimpse into Our Feature-Rich Crypto Exchange Website Development

Discover our Robust Exchange Architecture and advanced features we built to deliver scalable, secure crypto exchanges, designed for fast deployment without coding delays.

Our Expertise Across Multiple Blockchain Networks

At Troniex Technologies, we focus on delivering blockchain edges to your project’s success. Every blockchain selection is intended for the same purpose. Check out the prominent blockchain networks we offer for cryptocurrency exchange website development Services.

Key Features Driving Our Cryptocurrency Exchange Platform Development

We offer advanced features in our cryptocurrency exchanges that prioritize trader preferences and market demands. Discover the core, security, and premium features that make our crypto exchanges shine in the crypto space.

-

Multi-Currency & Language Support

Expand your crypto exchange’s reach by enabling the platform for multi-currency and multi-lingual support. Our crypto trading platform handles real-time currency conversion and localized trading experiences, designed to offer seamless access for global users.

-

Advanced Order Matching Engine

Level up your crypto currency exchange with a high-performance order matching engine. With support for limit, market, stop, and conditional orders, our exchange platforms are tuned for precision and low latency.

-

Diverse Wallet Integrations

Enable users to access crypto assets securely with integrated hot or cold wallets for active trading. The wallet integration supports multi-signature access, dynamic address generation, and blockchain node connectivity for securely managing user funds.

-

Real-Time Admin Dashboard

Take control of your exchange with a comprehensive admin panel featuring real-time analytics, user management, and activity tracking. Keep monitoring KYC status, trade volumes, and wallet balances, and make informed decisions.

-

Liquidity API Management

Maintain seamless trading experiences with internal liquidity modules and external aggregator API support. Enable your exchange for real-time price feeds and trade execution through WebSocket APIs to maximize your exchange’s liquidity.

-

Mobile Trading Applications

Enable your users for secure mobile trading with a responsive UI and advanced trading functionalities. Our mobile trading applications support push notifications, biometric login, and real-time charting, enhancing user convenience and performance.

-

High TPS Capability

Manage massive transaction volumes with a high TPS exchange engine. Our exchange solutions are optimized for high-frequency trading, capable of executing thousands of transactions with low latency and horizontal scalability.

-

Diverse Trading Options

Our cryptocurrency exchange development services enable users a full spectrum of trading features, including spot, margin, futures, perpetual, etc. This helps you serve different traders and allows users to set trading strategies.

-

Crypto Swapping

Enable instant, hassle-free crypto swapping feature with automated price discovery at minimal slippage. Our crypto trading platform supports internal liquidity pools, allowing users to make fast conversions within a few seconds.

Security Features

-

KYC/AML Compliance Integration

KYC/AML Compliance Integration

-

Two-Factor Authentication (2FA)

Two-Factor Authentication (2FA)

-

Multi-Signature Wallets

Multi-Signature Wallets

-

Encryption and Cold Storage Solutions

Encryption and Cold Storage Solutions

-

Real-Time Risk and Fraud Management

Real-Time Risk and Fraud Management

-

DDoS Protection and Secure API Access

DDoS Protection and Secure API Access

Premium Features

-

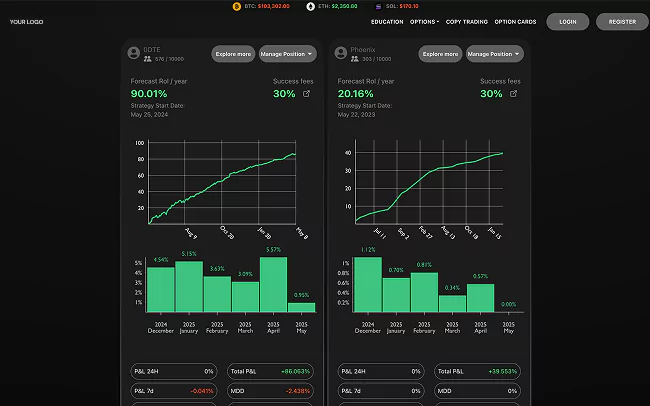

Copy trading

Copy trading

-

Paper Trading

Paper Trading

-

Spot Grid Trading

Spot Grid Trading

-

Futures Grid Trading

Futures Grid Trading

-

Crypto Arbitrage Trading

Crypto Arbitrage Trading

-

Margin and Futures Trading

Margin and Futures Trading

-

DeFi and NFT Marketplace Integration

DeFi and NFT Marketplace Integration

-

AI-Powered Trading Tools

AI-Powered Trading Tools

-

IEO/ICO Launchpad

IEO/ICO Launchpad

-

Analytics and Reporting Tools

Analytics and Reporting Tools

Add-On Modules

-

Staking and Lending Modules

Staking and Lending Modules

-

Referral and Affiliate Programs

Referral and Affiliate Programs

-

Dispute Resolution Mechanisms

Dispute Resolution Mechanisms

-

Customer Support Modules

Customer Support Modules

-

Marketing Tools

Marketing Tools

-

White-Label Customization Option

White-Label Customization Option

What Specialized Services Do We Deliver for Crypto Exchange Platforms?

At Troniex Technologies, we empower entrepreneurs with targeted crypto exchange services focused on profitable trading environments for specific targeted audiences. Choose the features that best align with your business goals to get started quickly and effectively.

Spot Trading Crypto Exchange

Launch powerful spot trading platforms that enable seamless buying and selling of cryptocurrencies at real-time market prices. Our spot trading exchange development solutions are designed with high-liquidity architecture, secure order matching, and intuitive trading interfaces to deliver the best experience for both beginners and professional traders.

Margin Trading Exchange

Allow traders to maximize returns with a margin trading exchange development featuring profit, loss, and position tracking and risk management. Our margin trading platform supports lending protocols, margin wallets, and collateral management for a smooth experience.

Futures Trading Exchange

We offer futures trading with customizable expiry dates, settlement engines, and more. Our crypto future trading platform development supports multi-sig contracts and order book visualizations, perfect for institutional and professional derivatives traders.

Perpetual Trading Platform

Launch a perpetual trading platform featuring funding rates and dynamic margin controls. Our crypto perpetual trading platform development solutions support isolated margin trading and automated liquidation, ideal for traders preferring great market exposure.

Crypto Copy Trading Software

Develop innovative crypto copy trading software that enables users to automatically replicate the trades of successful traders in real time. Our solutions offer seamless integration, performance tracking, and risk management features, empowering novice and experienced traders to maximize profits with minimal effort.

Cryptocurrency Exchange Development Solutions Built to Scale

At Troniex Technologies, we offer client-friendly cryptocurrency exchange development solutions that support seamless trading, advanced security, and real-time transaction processing. Whether you need a custom solution or a white-label platform, we have the solution to meet your needs.

We provide comprehensive crypto exchange software development services, building every component from scratch. From blockchain integration to trading engine design, we deliver a unique, fully optimized crypto exchange tailored precisely to your business goals.

Launch your crypto exchange instantly with our customizable, pre-built exchange script, designed to meet your enterprise needs. Securely coded and equipped with essential trading features right out of the box, this solution streamlines deployment and minimizes costs for a faster market entry.

Build your branded exchange platform and customize it to your enterprise goals with our white-label exchange solutions. Our White Label Cryptocurrency Exchange Development solutions are ideal for launching a crypto exchange in compliance with industry standards.

As a leading crypto exchange app development company, we enable your users to access your exchange services through a powerful mobile app. With real-time trading freedom at their fingertips, users can trade on your platform anytime, anywhere

Get an expert-built exchange tailored to your business goals.

Essential Revenue Models in Cryptocurrency Exchange Development

Our exchange revenue models outline the various ways exchanges generate income through trading fees, commissions, subscriptions, and value-added services. These models ensure sustainable growth while catering to diverse user needs and market demands.

-

Trading Fee

The exchange charges a maker and taker fee for the users to buy and sell cryptocurrencies. Once the trade volume increases fee will increase.

-

Token & Coin Listing Fees

New crypto projects/Coins/Tokens pay a fee to the exchanges to list their tokens. Based on the community of the new projects, multiple revenues will be generated.

-

IEO Fees

Through Initial Exchange Offering (IEO), the exchange comes with a commission-based percentage from the raised funds or a fixed price to launch a project.

-

Deposit & Withdrawal Fees

Exchanges can charge users when they deposit or withdraw funds as a percentage-based or flat fee covering operational costs.

-

Margin Trading Fees

Users/Traders borrow funds to trade with leverage to increase their principal, and the exchange earns interest on these borrowed amounts, also with maker and Taker fees on leveraged amounts.

-

Staking Fees

Through staking admin can raise funds to manage the liquidity and can utilize it. Also admin can earn a small fee as a service fee for staking.

How Much Does It Cost to Build a Crypto Exchange Platform?

The cost to build a crypto exchange isn’t fixed, it depends on your chosen provider, feature set, and customization. Factors like wallet integration, payment options, trading modules, and tech stack all influence the final price.

Whether you need a ready-for-market solution or a tailored advanced exchange, we deliver robust, bug-free platforms that match your business goals and budget.

Starter Exchange Package

$4,800 – $7,500

# Perfect for rapid launch.

Advanced Exchange Solution

$10,000+

# Endless integrations for limitless scaling.

Our Portfolio

Code,Deploy,Dominate!

Future Proof Technology, Stacked for Your SUCCESS!

HTML5 & CSS3

HTML5 & CSS3

React Js

React Js

Angular Js

Angular Js

Vue Js

Vue Js

Next Js

Next Js

Java

Java

Python

Python

Node Js

Node Js

PHP

PHP

C/C++

C/C++

Rails

Rails

SQL

SQL

Mongo DB

Mongo DB

Kafka

Kafka

Nginx

Nginx

Apache

Apache

Heroku

Heroku

CloudFlare

CloudFlare

AWS

AWS

TensorFlow

TensorFlow

Docker

Docker

Kubernetes

Kubernetes

Jenkins

Jenkins

Kotlin

Kotlin

Trade Giant

Trade Giant

React Native

React Native

Flutter

Flutter

Wordpress

Wordpress

Magento

Magento

Shopify

Shopify

Drupal

Drupal

Hyperledger

Hyperledger

GO

GO

Rust

Rust

Solidity

Solidity

Our Trusted

Client Testimonial

Our partnership with Troniex has been fantastic. Their team is professional, committed, and always supportive. Their quality work and reliability helped us launch our project on time. I truly appreciate their support.

Project: Casino - Poker

Alex

Partner, Brevin

We are excited to work with Troniex on another project! My colleagues and I were impressed by their professionalism, attention to detail, and the support they provided during our project. Thank you guys for being with us

Project: Fibitpro

Nilesh

Sr. Consultant, Fibitpro

You guys really deserved my trust! I recommend Troniex, who need a perfect partner to setup a business. Mr. Saravanan and Mr. Rajasekar are highly motivated and talented, helped me to launch my business effortlessly.

Project: Poker Bet

James Mathew

Software Architect

I'm truly grateful to Troniex Technologies for bringing my business idea to life. Their expertise and attention to detail made the whole process smooth. I highly recommend their team to anyone looking for reliable support.

Project: Apex21

Arnold

Apex Crypto Academy

Crafting Success

Proven Crypto Exchange Development Process for Effective Market Entry

Our Crypto Exchange Development Process is enriched with a structured approach from requirement analysis to final deployment. The process focuses on security, scalability, and user experience while delivering a robust, high-performance trading platform.

We start by providing consultation to understand your business goals, regulatory requirements, and market needs. Our team defines the core features, security modules, trading engine, and integration services to build a robust crypto exchange platform.

01

Our design team builds a clean interface that ensures easy accessibility across devices. With advanced tools, we create interactive prototypes and user flows, allowing early-stage checkups before moving into development.

02

Our expert developers develop the core architecture of the crypto exchange using cutting-edge technologies. We ensure the features of the crypto trading platform are perfectly aligned with performance, security, and scalability.

03

Our testing team conducts thorough testing, including functional, performance, and security auditing. We ensure the crypto exchange platform is optimized for your business needs and meets industry standards for security.

04

Once the testing phase is completed, we deploy the exchange platform on the main server. The deployment process ensures minimal downtime and covers real-time assessment to guarantee seamless live operations.

05

During the Post-launch development phase, we provide continuous monitoring, bug fixes, and updates. Our support includes platform upgrades, compliance, and security updates, ensuring your crypto exchange remains competitive and secure.

06

Why Troniex Technologies is Your Trusted Crypto Exchange Development Partner?

Troniex Technologies is a leading cryptocurrency exchange development company specializing in delivering business-friendly crypto exchanges as per client requirements. We are a team of experts having strong blockchain knowledge, experienced for quicker and effective action plans. We build crypto exchanges on reputable blockchains, ensuring security, scalability, and productivity to help businesses launch a powerful exchange business. We provide complete services tailored to your needs by keeping up with changing regulations, new technologies, and user expectations. Get connected with us to turn your crypto ideas into a reliable, profitable crypto exchange business